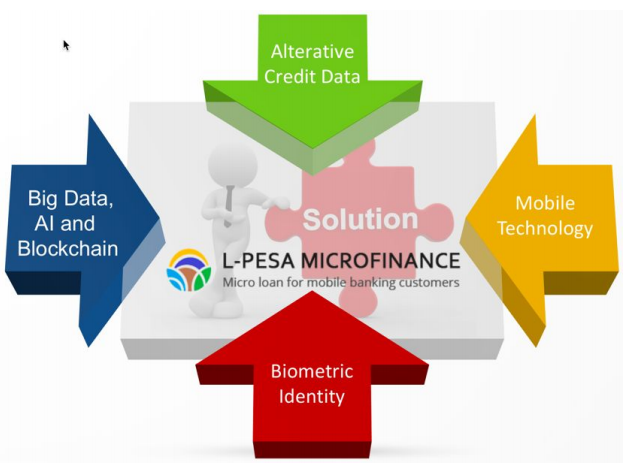

L-Pesa is a financial service that has helped millions of people around the world grow their finances through microcredit. Make quick decisions to maximize the benefits available. Use L-Pesa as more of a service that will help you get out of poverty. Choose Krypton as the perfect financial tool to give you the foundation you need to make your dreams come true. L-Pesa Microfinance is a fintech startup that is ready to take advantage of the fast-growing needs for financial services in the developing world. The company has validated its operating model over the past 24 months and has built up advanced technology, automating most of the operations. The main barrier to growth at this point is its ability to fund user acquisitions and loans. The loan loss ratio goes below 10% while the loan repayment is around 25%. The idea for L-Pesa was incubated for a decade, and the business was launched at a time when four important market forces gathered to allow scaling:

• Big Data, Artificial Intelligence & Blockchain

• Alternative Credit Data

• Cellular Technology

• Biometric Identity

L-Pesa has leveraged this market power and built-in technology and exclusive credit scoring model that enables it to scale microlending rapidly in developing countries while keeping a loss ratio below 10%. The solution is highly automated, allowing small back office teams to support high volumes

origination loan. All loans are serviced by L-Pesa. Ron Ezra Tuval, founder and managing director of L-Pesa, has extensive experience in developing countries, particularly related to agricultural projects and technology-related tourism. Ron first came microfinance in Southeast Asia and spent a decade incubating the idea

L-Pesa while waiting for the technology needed to mature. Ron has built a strong and diverse team for L-Pesa with domestic managers operating in Tanzania, Kenya and Uganda, and development teams in India. There are also back office teams in Tanzania, Kenya and Uganda handling background checks, credit approvals, and customer service. Technology, marketing, and accounting teams operate on virtual models and consist of experienced staff based in Europe, the United States, Africa, and India. L-Pesa has a strong focus on automation. 95% of user acquisition and loan underwriting processes are automatic and therefore highly scalable. The company has spent two years developing its customers and returning

office systems use a team of seven software developers. User experience is based on mobile and web interface, and marketing is mainly achieved through social media and SMS. The L-Pesa technology stack builds on Amazon Web Services, a highly scalable on-demand cloud computing platform that has been or used by major brands such as Netflix, Airbnb, Pinterest, and Spotify.

L-Pesa has integrated a number of third-party applications to perform tasks such as SMS messaging, user verification, and marketing. Fund transfers are handled through integration with mobile money service providers such as M-Pesa, Airtel Money, Tigo Pesa, and MTN. L-Pesa has issued more than 38,000 loans since it aired in March 2016. Over 170,000 users have been registered based on social marketing campaigns that run a minimal budget. The marketing strategy has been refined over the last 24 months, and L-Pesa is now ready to launch a marketing campaign via SMS and social media with a $ 1.00 conservative projected customer acquisition cost.

Founder of L-Pesa, has invested about $ 500,000 to date. That

business launched in Tanzania in 2016 and in Kenya in August 2017. Gentle launches are underway in Uganda and India. Company technology is stable, scalable, proven, and will support the company's growth plan. At this point, L-Pesa has reached growth barriers - there is not enough capital available to lend to all interested people, and the potential for users Acquisitions are virtually unlimited but require capital for marketing costs and support staff. The company is now raising funds to capitalize on its leading position, a powerful platform, and an almost limitless opportunity to extend financial options to the vast majority of the earth's population.

Market Overview and L-Pesa Solutions.

Our vision is to improve people's lives through the efficiency of access to credit and related financial services. North America, Western Europe, and some other parts of the world look a tremendous increase in living standards over the last two hundred years of the year. Using the simplest standard of living standards, Gross Domestic Product (GDP), a remarkable improvement can be seen in what we now refer to as. developed countries. For example, from 1820 to 1998, GDP (adjusted for inflation) in the US increased by a factor of 21.7. Western Europe saw an increase ranging from factor 11 to Great Britain to a 23.5 factor for Finland. Although the national increase in Wealth has not been equitably distributed, it is clear that the improvement of living standards for everyone is enormous. In contrast, GDP (adjusted for inflation) in India and Africa only increases with factors. These underachievers have and continue to have countless human costs. Over the last hundred years, countries with higher standards of living have sought to help countries in Africa or Asia, but the development assistance provided proved inefficient since then living standards have not increased anywhere close to the speed that the developed countries look . The reasons for the failure of many development aids are, but there is growing recognition that new tools should be used to improve living standards in Africa and Asia. The World Bank stated, "Financial inclusion has been widely recognized as important in reducing poverty and achieving inclusive economic growth of the World Bank. Financial inclusion, defined as the ability of people to use financial services, is now the main focus of most public and private sectors

organizations that focus on reducing poverty and fostering economic growth. Imagine the results in Africa and India if for the next fifty years, the pace of economic growth is the same or better as in North America or Western Europe in the last 200 years. Those born in Africa and India this year will find themselves in a world that really changes when they are fifty. Most common causes of early death today are almost forgotten and

the standard of living will reach an unimaginable standard today.

Hundreds of millions of people will be saved from premature death. Inadequate housing will be a distant memory. The political system and

civil society will evolve as the current rising standards and endemic corruption will be eradicated. Perhaps even lasting peace can be achieved, as happened in Western Europe for the last seventy years. L-Pesa was founded with a vision to improve people's lives of efficient access to credit and related financial services. Ron Ezra Tuval, the founder of L-Pesa, has spent most of his career working in country development and was recognized about a decade ago that the most effective way to improve people's lives is through access to credit and related finance

services. Since establishing L-Pesa, Ron has focused specifically on achieving this vision. It's about making the world a better place for everyone. L-Pesa began offering microfinance services in Tanzania in 2016. and has grown its service offerings and geographical footprints at an accelerated pace in pursuing this vision.

L-Pesa Solutions

The idea for L-Pesa was incubated for a decade, and that business

launched at a time when four important market forces converge to allow rapid scaling.

Large Data, Artificial Intelligence, and Blockchain The new tools allow the storage of large amounts of data and extensive data analysis at a fraction of the cost of a few years ago. Advances in artificial intelligence provide novelty opportunities for automated loan underwriting. Blockchain technology allows for faster, safer, and cheaper exchange of values. Blockchain technology has just begun to revolutionize financial services and will result in enormous efficiencies The next ten years the blockchain has been described as internet money and will do for the financial. internet services for information and commerce. Alternative Data Credits A decade ago, very little data was available to most people in the world. This has changed with the advent of social media and

related trends. New tools have been developed to create this data

useful for decision making in loan guarantees.

L-Pesa has developed a unique exclusive credit scoring model based on a combination of user behavior with traditional and alternative credit data. L-Pesa competitors have developed their own

model. The experience over the next decade will lead to revise best practice, which will eventually become the industry standard.

Mobile Technology The advent of mobile phones over the past two decades has been one of the most in-depth technological shifts and markets in human history. A large number of people now have mobile phones, and many smartphones themselves. Cellular financial services such as M-Pesa have become available in many countries and support both turns as well as populations that do not have bank accounts. Based on market penetration of mobile phones (smart phones and feature phones), mobile money services like M-Pesa, Tigo Pesa, and Paytm have grown very fast and have enabled L-Pesa. Identity Biometrics Traditional microfinance relies heavily on large branch networks since identity verification is not possible online and is difficult directly.

The Indian Aadhaar IDometric System leads the world and has registered> 99% of India's 1.2 billion citizens. Other countries are expected to follow India

a successful implementation. Biometric IDs will be generated dramatically reducing the cost and ability to provide financial services without a physical branch of the network. L-Pesa has leveraged this market power and built-in technology and exclusive credit scoring model that enables it to scale microlending rapidly in developing countries while keeping a loss ratio below 10%. The solution is highly automated, allowing small back office teams to support high-volume origination loans. All loans are serviced by L-Pesa. The services offered by L-Pesa L-Pesa are established with a vision to improve people's lives of efficient access to credit and related financial services. The first service offered by L-Pesa is micro-loans. L-Pesa was launched in Tanzania in 2016 and has issued more than 38,000 loans. Over time, L-Pesa expects to introduce additional financial services that will appeal to its user base, such as a money transfer service. The company has a strong focus on automation. 95% of user acquisition

and automated borrowing underwriting process and hence very remarkable

measurable. They have spent two years developing their customers and back office systems using a team of seven software developers. User experience is based on the interface and mobile and web marketing is mainly achieved through social media and SMS.

L-Pesa has built a proprietary credit underwriting system that is one of the keys to its success. Consumer credit reporting as available in Western Europe and North America does not exist in Africa, India, or other regional developments. A number of models have been tried for years, some with more success than others. The L-Pesa model is based partly on the ladder trust: the user starts with a very small loan (usually $ 1.00) and allows for larger loans after a smaller loan successfully restored the event arrangement. Successful payments contribute to the credit score. Credit Scores are also influenced by other factors, such as verifying identity completion. Furthermore, L-Pesa relies on other service providers to filter users; in the market today, L-Pesa customers must have established accounts with mobile money service providers such as M-Pesa before setting up an L-Pesa account. The credit scoring system allows L-Pesa back office users to be an efficient means of processing loan applications. Below is a view of the L-Pesa admin interface with a list of loans pending approval.

Each user's credit score is visible in column four. Last column in

the right provides a visual indicator of a wide range of factors

impact approval, such as ID verification, previous loan experience, etc. Many loans are approved automatically, but some require manual review. That algorithm governing auto approval continues to be refined. One of the most significant achievements during the last twelve months of operation has been a reduction in the ratio of loan losses to less than 10%. This is unbelievably successful for unsecured consumer loans in any geographical area, but the fact that L-Pesa has achieved this in eastern Africa is truly amazing. The process by which L-Pesa has achieved this success is described in the figure below.

1.Users register accounts in L-Pesa, often in response to social media posts or SMS marketing messages. Over time, L-Pesa expects that a large number of account opening will come from references from existing users.

2. Users add documentation to their L-Pesa account, usually

identification documents such as driver's license or passport.

3. L-Pesa staff verifies identity. Much of this work

automatic, and more automation will be added in the coming months.

4. Users apply for initial loan, usually for local

equivalent to $ 1.00. In many cases, this application is automatically approved.

5. Subsequent loan applications are handled in the same way: automation based on a user's credit score is the key to success and scale.

6. Once the loan is approved, disbursements are processed in real-time using cellular money services such as M-Pesa or Tigo Pesa.

7. Users are given a payment plan and are expected to make regular loan payments. Payments are also made using cellular money service. Users can make prepay without penalty. Payment arrears will impact the user's credit score and will generate an automated message for the user. Handling delinquency is very efficient, resulting in a loss ratio of less than 10%.

8. User support is handled by the L-Pesa back-office team in Tanzania.

User support is available in English and Swahili through social media channels, email, and phone.

Market dynamics.

The target market of L-Pesa will target markets containing more than 40% of the African earth's population, the Indian sub-continent, and Southeast Asia. The current population is over 3 billion people, and the population is growing rapidly. L-Pesa is the first mobile solution, based on mobile usage. The penetration of mobile technology is currently very high and growing: India is at 92% penetration and many African countries are over 70%. L-Pesa works on smartphones and feature phones. L-Pesa relies on mobile money service providers for liquefaction and collection, making the process quick and efficient. Many countries initially targeted by L-Pesa have a high proportion of the population who do not have bank accounts, making mobile money services like M-Pesa a good choice. India has a higher percentage of the population with bank accounts, and Aadhaar's biometric ID database is now linked to bank accounts, making liquefaction and collection in India potentially very efficient in the near future. Dependency on mobile money service users in Africa limits L-Pesa users by basing to users with their mobile money service wallet. By mid-2017, there are about 170 million wallets used in Africa. In India, more than 1 billion Aadhaar users have linked their bank accounts.

The available L-Pesa market will far exceed L-Pesa's loan capacity

and all its competitors for the foreseeable future. Limiting factor for

growth is not expected to be a user who wants to try L-Pesa but rather the availability of capital for a loan.

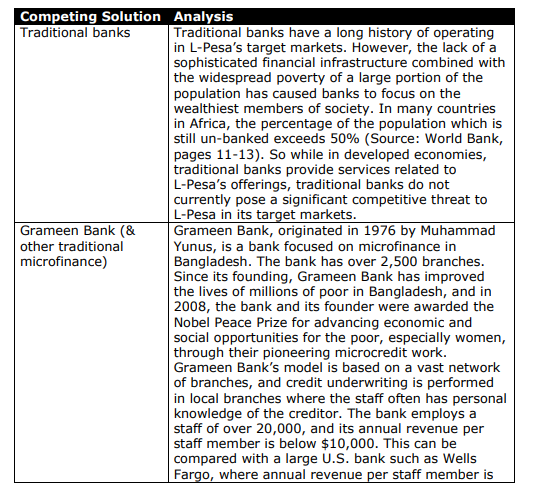

Competing Solutions.

L-Pesa faces competition from several categories of solutions available at

market today.

Tala and Branch are both very similar, and both are equally targeted

some of the same countries in East Africa. However, due to the broad market, their competition is more likely to support each other than taking one business from another tidal wave lifting all the boats. In addition to the competitive solutions identified above, there are numbers of mobile money service providers who could potentially decide to enter the market. Some of them partnered with L-Pesa today:

● M-Pesa

● Tigo Pesa

● Airtel Money

● MFS Africa

● True Africa

In India, one of the main markets of L-Pesa, the strong adoption of Aadhaar's identity system is likely to lead to major innovations in financial services. Since the Indian population is not un-banked at the same level as in sub-Saharan Africa, market evolution in India is likely to occur following an unpredictable path. The description of the L-Pesa business model The key to the L-Pesa business model is:

● A highly automated back office system that allows almost

complete automation of the tasks associated with loan guarantees and service loans.

● Integration with mobile money service providers for efficient loan disbursement and collection of payments.

● A highly efficient loan origination process - fully online and almost completely automated.

● Exclusive credit extension model that has been refined for

38,000 first loans issued by L-Pesa to generate a loss ratio below 10%. The main features above L-Pesa produce an operating model that benefits all L-Pesa stakeholders:

● L-Pesa customers have access to affordable financing options that can help them improve their lives.

● Third-party capital providers of L-Pesa can mobilize capital that results in attractive returns.

● Shareholders and employees of L-Pesa can obtain a reasonable return on their investment and labor.

Token LPK L-Pesa

L-Pesen and crowdfunding smart contract Tokens distributed during token launches are known as LPKs. The token LPK is a standard ERC20 token (on the Ethereum platform) allowing one to use the LPK application. The utility opened by the LPK token is

ability to participate in LPK project token offerings, get access to functions only opened through use of exclusive token of L-Pesa network. Participation by members is key to LPK

platform. Over time, more functions will be released that help improve network utilization through tokens for the benefit of the network. The smart contracts used in the early stages of the project, consisting of

two main modules:

1. Token contracts that follow the ERC20 standard.

2. A crowdfunding contract that enables the campaign participants

send their contribution in ETH.

3. 1 ETH = 17,500 LPK.

Token ERC20 and additional functions

Token LPSA ERC20 uses the standard functions described in

follow the location of Github https://github.com/ethereum/EIPs/blob/master/EIPS/eip-20-token-ard

.md In addition to the set of methods and variables described in ERC20

standard, token contracts inherit other common properties of the library set designed by OppenZeppellin, described below Github Location:

https://github.com/OpenZeppelin/zeppelin solidity / tree / master / contracts / token

The Owned Library is responsible for automatic assignment of the contract

owner to the person who spread the contract. In addition, it provides

functionality to provide ownership of the contract to the new owner.

The Pausable library provides a set of modifiers that control the flow of contributions by flag paused. Two functions, pause and Pause, can be used to set the above flag to "true" or "false". SafeMath libraries are used to perform mathematical operations such as addition, multiplication, and subtraction in a safe way to avoid overflow of errors in case inputs exceeding acceptable values. In addition to the ERC20 standard, token contracts are equipped with functions and modifiers allowing owners to restrict token transfers to authorized persons during crowdfunding campaigns, so contributors can not sell their tokens to others until the campaign ends.

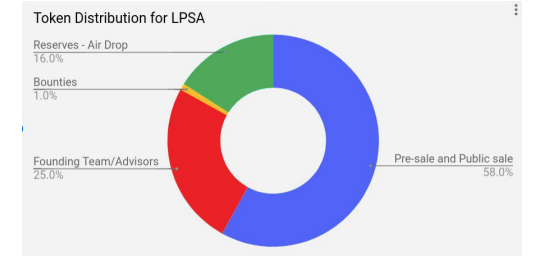

Token Distribution.

Distribution of Token LPK:

Total tokens are sold 2,600,000,000

Total Token Sale 58% (of all tokens created) Management and Team 15% Advisor 10% Bounties and References 1% Business Development 16%

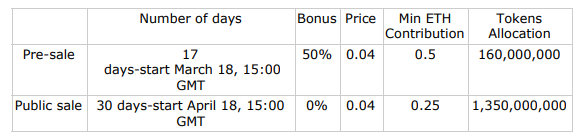

Token Price: 1 ETH = 17,500 LPK Lockout period Token: Until the end of ICO. Token Activation: One day after the completion of ICO Token Storage: Krypton ERC20 token will be stored in L-Pesa user's wallet. During the locking period, users will be able to exchange ERC20 Krypton

Tokens on the L-Pesa social market. Kripton L-Pesa ICO timeline: Pre-sale starting March 18, 2018 / 15:00 GMT Pre-sale ends April 3, 2018

ICO from 10 April 2018 / 15:00 GMT The ICO expires on May 10, 2018.

Allocation of Token.

Supplay token LPK as much as 2.600.000.000 LPK with Hard-Cap $ 52M USD.

- 1% is allocated to Bounty and Referral Programs

- 10 is allocated to Counsel

- 16% are dedicated to business development

- 15% is allocated for management and team

- 58% is allocated for token sales

Summary of Token Launch.

Token Name: KRIPTON

Token ticker: LPK

Token Owner: L-P Kripton ltd., Suite 2B, 143 Main Street, Gibraltar

GX111AA. Company Number: 116865

REID Number: GICO.116865-49

Token Type: Ethereum ERC20

Total token issued: Maximum 2,600,000,000 total. The final amount

the token created will be calculated based on the final contribution amount. The final number will be published at the end of ICO. Mining: There will be no mining or other means to increase the token amount, save the second ICO in the future. Use of results: See the "Use of Sales Results" section in this document. Bonus: During the personal and pre-sale period, participants will be eligible for the following bonuses.

for information on kretton letters visit below.

Website | Whitepaper | Twitter | Facebook | Telegram | ANN Thread | Medium

AUTHOR: Gibsoun

Tidak ada komentar:

Posting Komentar